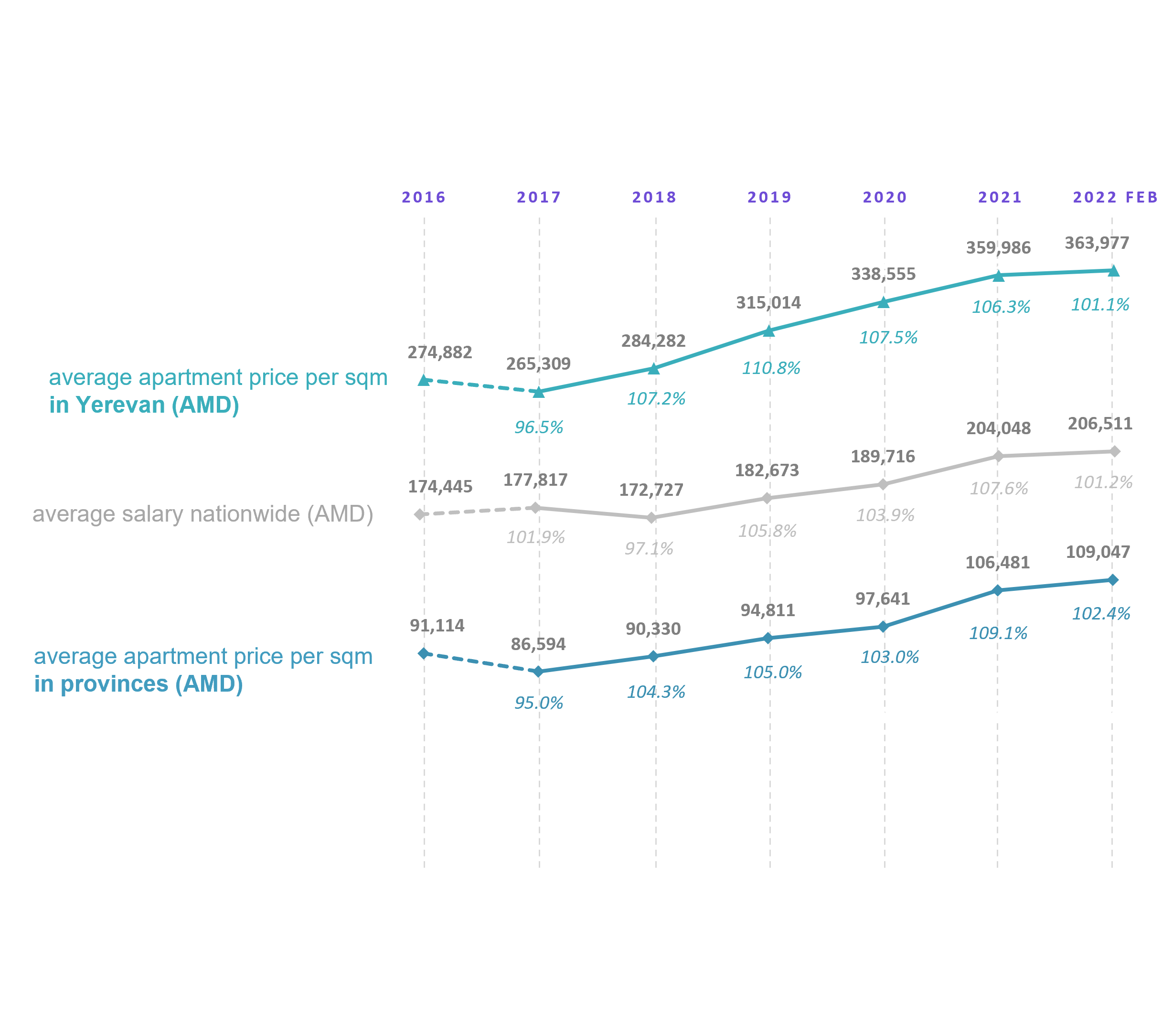

A remarkable observation here is that despite a significant drop in residential property transactions in 2020 (a nearly 22% decrease across all cities), property prices kept growing steadily. The trend has persisted into the year 2022 – with further potential for increase being unprecedented if, at some point, the temporary migrants penetrate the residential ownership market as well. So far, the most recent data for both median salaries and national average per-square-meter prices is from February 2022 and does not yet show the “premium” imposed by this growing demand for dwelling space.

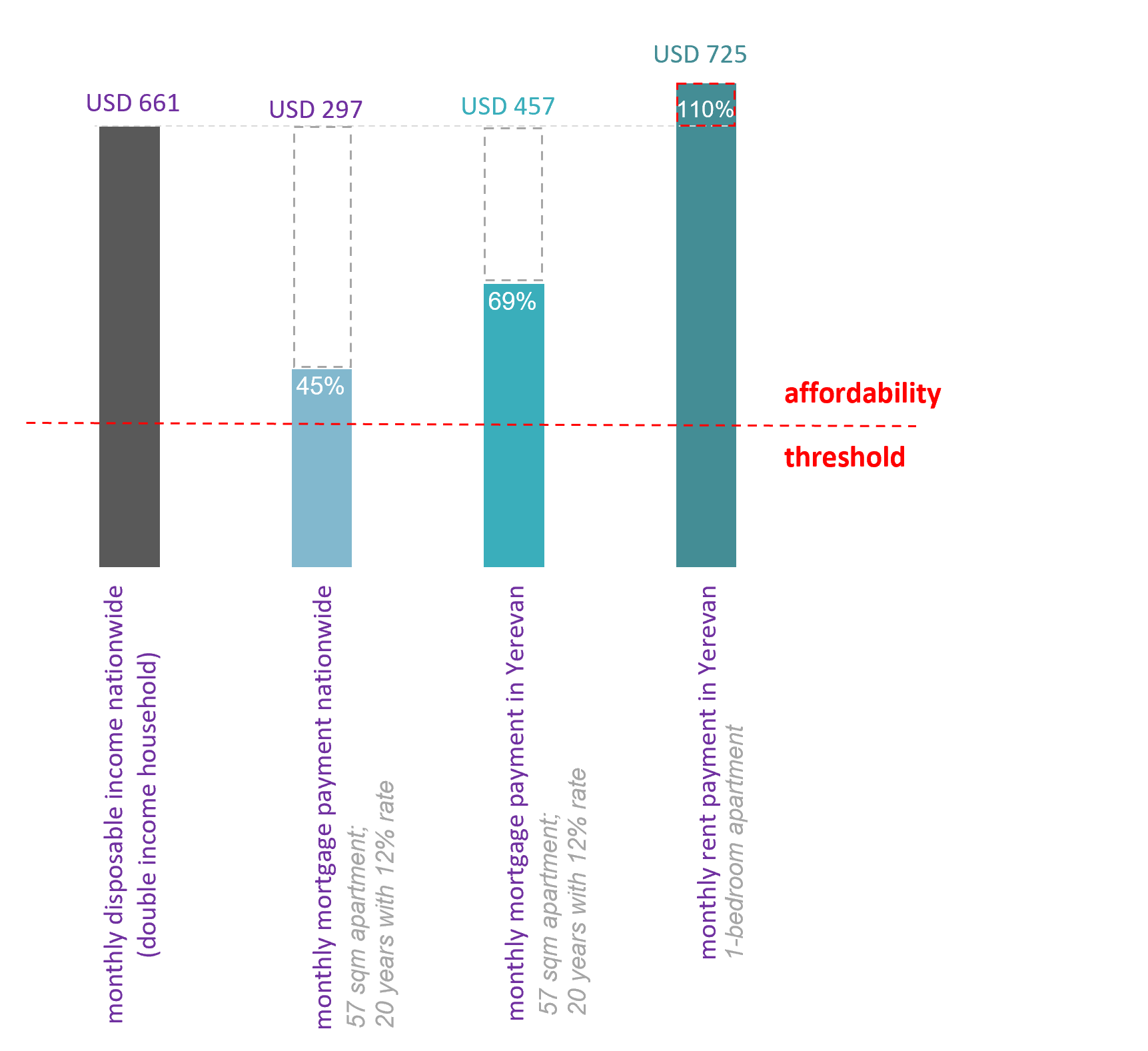

The apartment. The calculation will be made for a generic case of a single household wishing to purchase a one-bedroom apartment of 57 sqm (the median area for a one-bedroom apartment in the country), with a realistic interest rate of 12% and a loan term of 20 years. The average price for such an apartment would amount to AMD 20,746,700 (around USD 41,493) in Yerevan, and AMD 6,215,679 (USD 12,431) in other cities. Considering the national average at 33.3 sqm of floor area per dweller, a family of even two would, on average, be looking at an apartment of above 60 sqm.

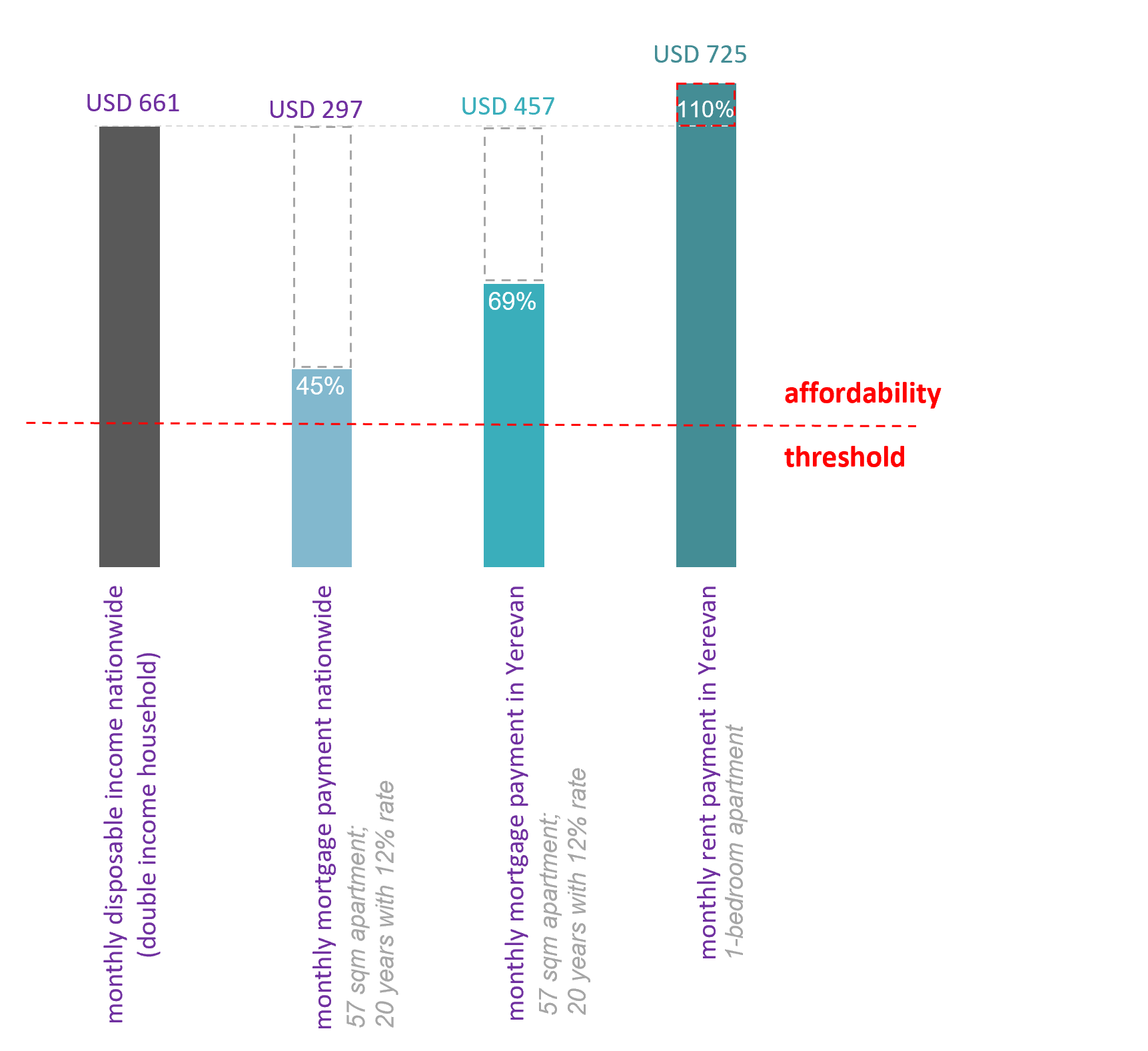

The household income. The assumption made here will be of a double-income household – not accounting for the higher unemployment and lower salaries among females (about 65% of their male counterparts). In this case, the generic household would be earning a median net income of AMD 368,500 (USD 737) in Yerevan and AMD 239,300 (USD 479) in other cities.

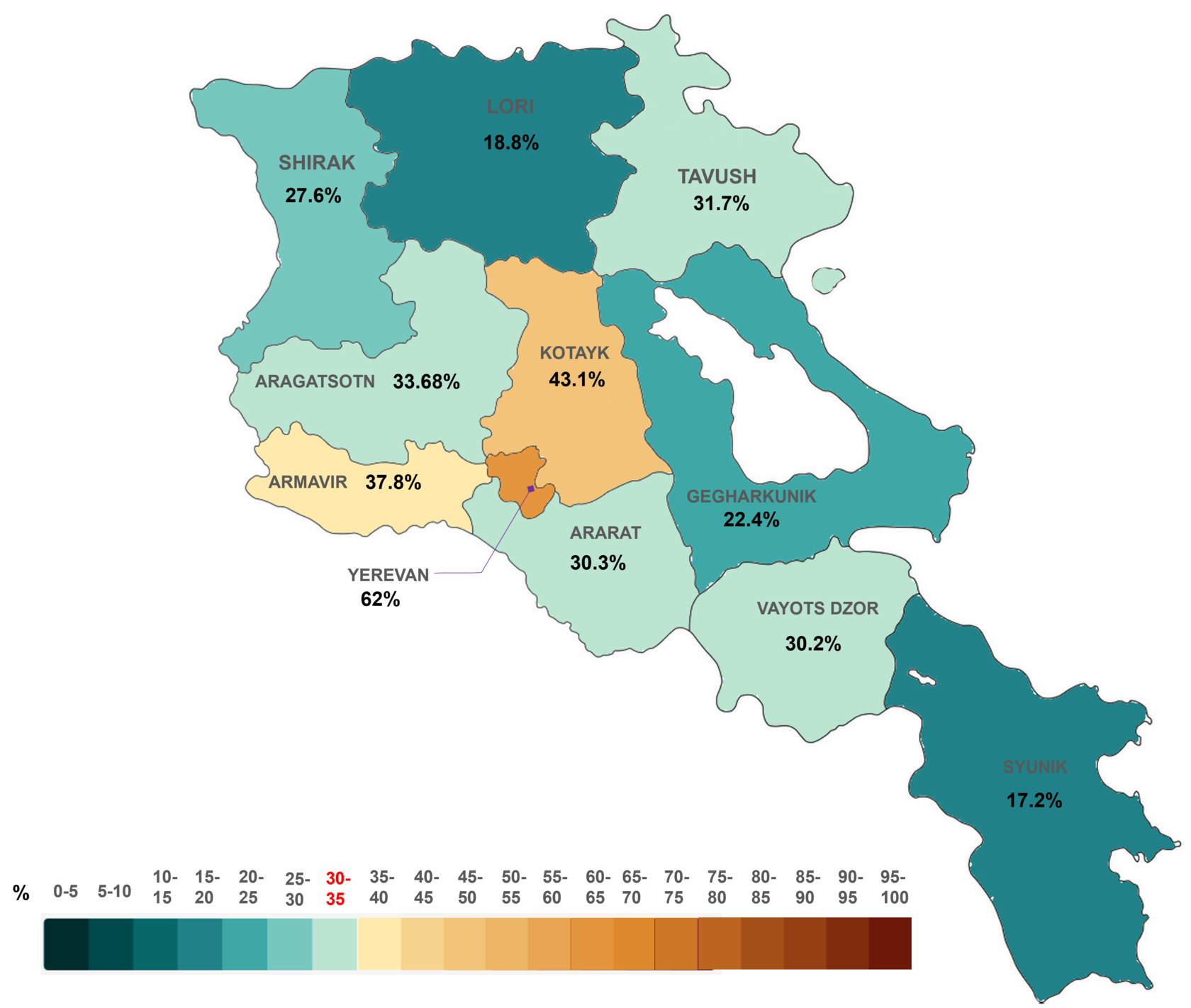

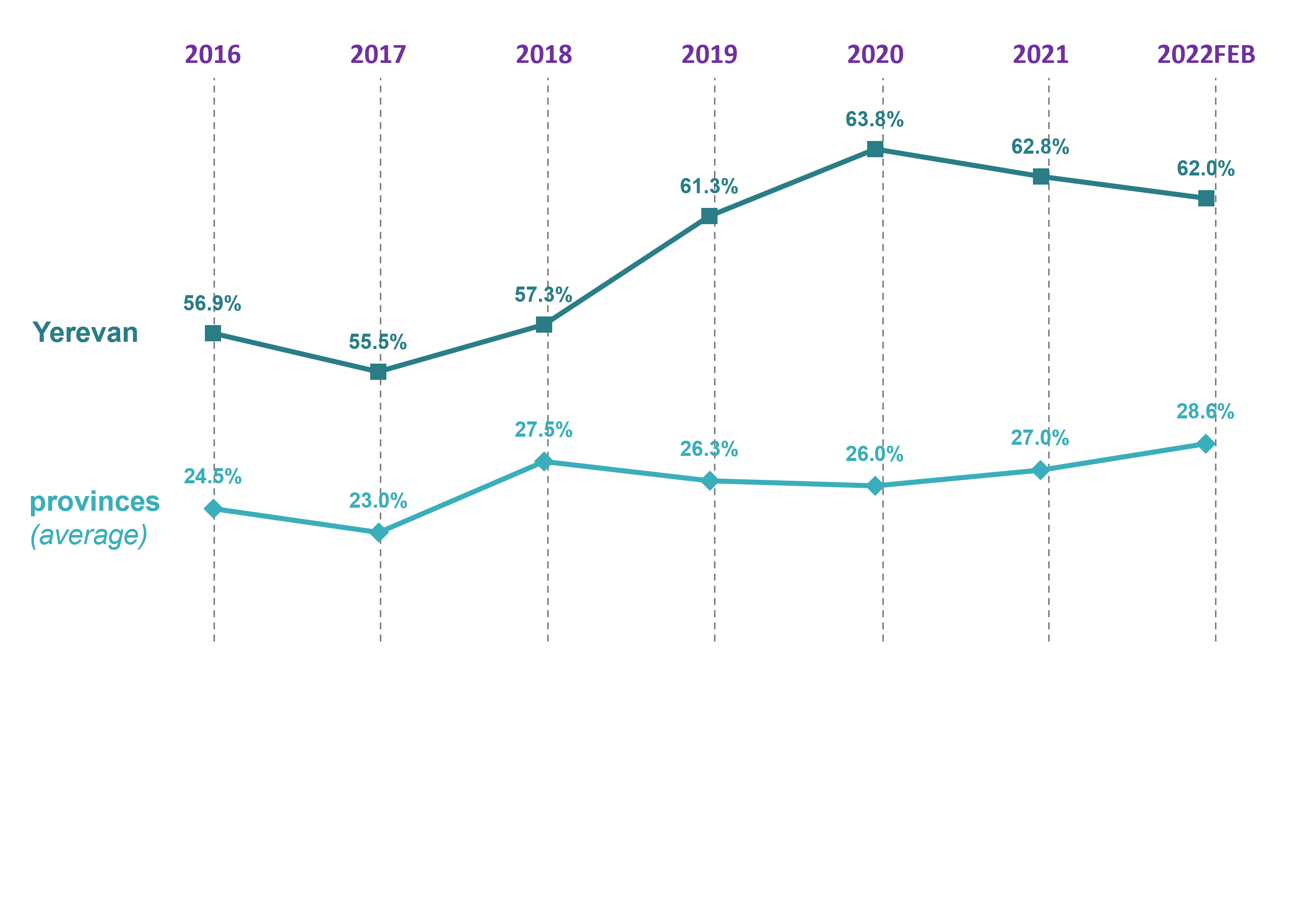

The income-to-price ratio. To pay off mortgage on the 57 sqm apartment, a double-income household would give away 62% of their collective disposable income in Yerevan and about 29% elsewhere in the country. For a single-income household, the ratio would double to 124% and 58%, respectively.

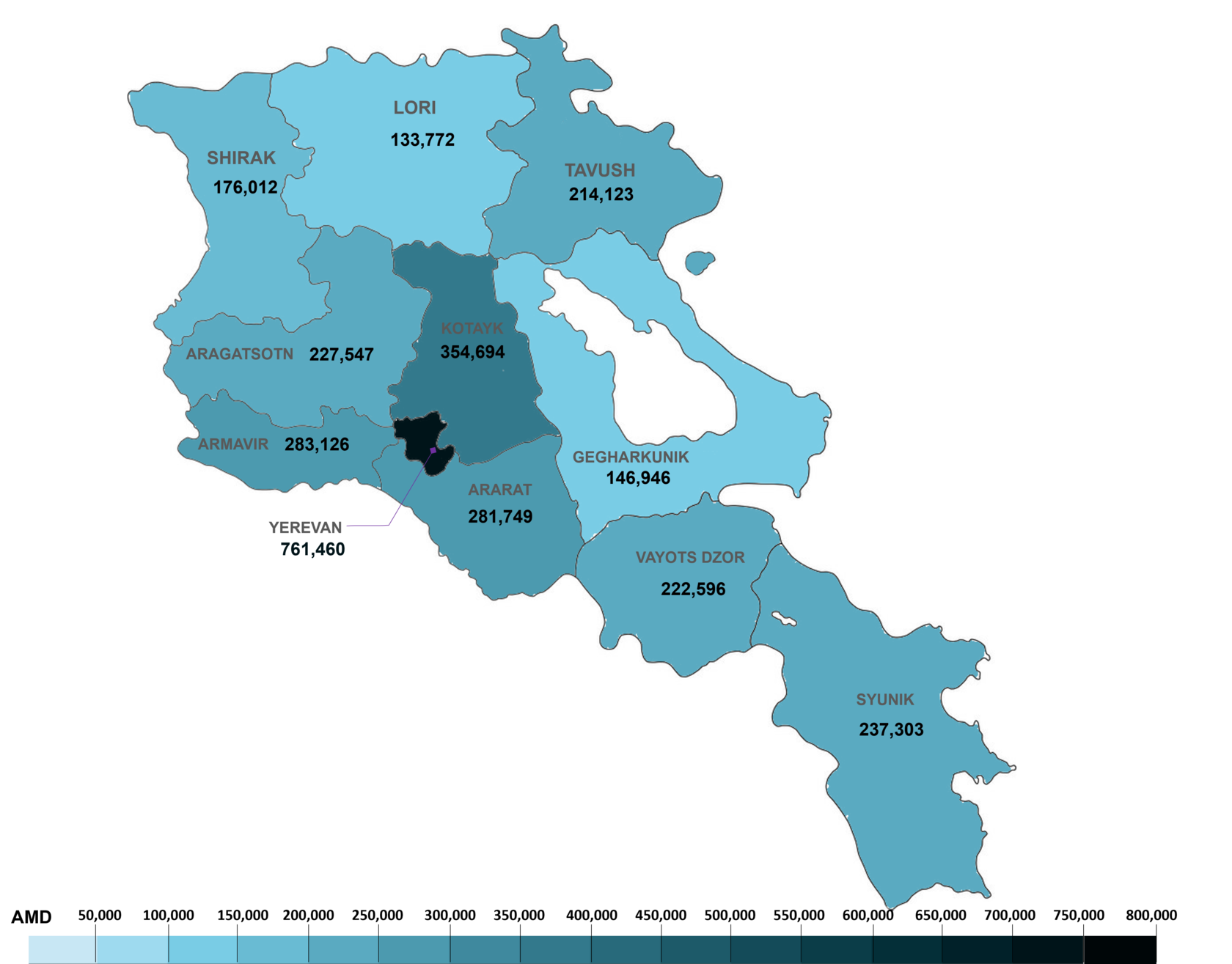

A reverse calculation: how much income is enough? Since the data on province-based per square meter prices is more reliable as opposed to the reported income values, a reverse calculation may be more informative – revealing the net incomes at which a household could affordably purchase a dwelling. In this way, the minimum net income – the 30% from which would be enough to pay a mortgage – is AMD 761,460 (USD 1,523) or two net salaries of AMD 380,730 (USD 761) in Yerevan, and an income of AMD 228,130 (USD 456) or two net salaries of AMD 114,100 (USD 228) in the provinces.

The calculations above do not, however, take into account the question of down payment or another property for collateral – a marker of wealth distribution rather than income, and the supportive policy of income tax return.

As for rental prices in Yerevan (so far, the most affected by temporary in-migration), the values were parsed from list.am – the most popular real estate advertising platform – and hence reflect the current offering prices as opposed to the actual going price. In this way, the average rental price for a one-bedroom apartment ranging from 35-60 sqm in the capital amounts to AMD 362,720 (around USD 725) – which equals two reported incomes in Yerevan. This explains the widespread evictions by landlords, who, even if do ultimately let their properties at lower rates, are still pricing the locals out.

To conclude…

Based on the reported incomes, housing in Armenia is barely affordable. If the average nationwide gross income of AMD 206,511 (USD 413) is any indication, a double-income household residing in the capital would be investing over half of their disposable income to purchase a 57 sqm apartment. As for the rest of the country, housing in eight out of ten provinces would be deemed affordable as per the 30-percent ratio rule – with four provinces being below the 30% mark, and other four within the 30-35% range. At the same time, a single-income household anywhere in the country would not be able to afford a housing.

The data from years 2016-2022 demonstrate that the events of 2020 have somewhat reverted the growing unaffordability of the housing-to-income ratio in Yerevan but remained consistent in the provinces.

Nevertheless, these values are extremely approximated given the drawbacks mentioned above: underreported incomes, size of the dwelling used in the case study being below what a family would necessitate for comfortable living, the assumption of two full median salaries making up the income. In addition, to realistically understand the housing market in Armenia it is necessary to look further into exogenous factors affecting it, such as speculative practices, hedonic pricing, number of residential properties per household.

At the moment, the unusually higher dwelling demand is a classical “symptom” of an exponential growth of city population with unprepared infrastructure in place. Most of the burden is borne by Yerevan, with less of the implications experienced in the provinces. It is true that if the influx of temporary migrants were more evenly distributed across more cities, the price-spiking effect would be mitigated. Yet the thing to keep in mind is that a growing demand for dwelling in the provinces is very likely to price out (read, lead to evictions) local renters and prospective homeowners very fast.

The current residential market situation is another reminder that making a profit on private property is the underlying theme of the supply-and-demand game – the business mentality if you will – which does require restraining levers in place to level the field for the haves and have-nots.

Go back ----->>>